The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Wiki Article

10 Simple Techniques For Custom Private Equity Asset Managers

(PE): spending in firms that are not openly traded. Roughly $11 (https://www.goodreads.com/user/show/172190636-madge-stiger). There might be a couple of points you do not recognize about the industry.

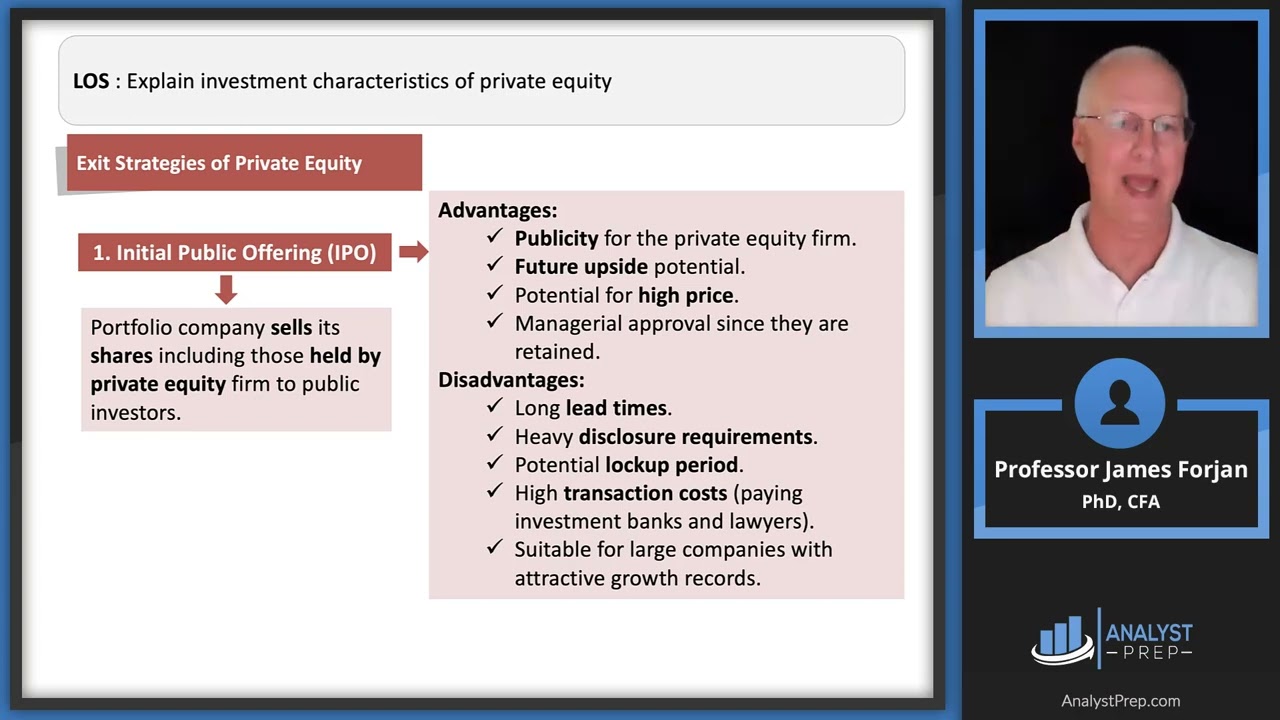

Companions at PE companies elevate funds and take care of the cash to produce beneficial returns for shareholders, generally with an investment horizon of between four and 7 years. Exclusive equity companies have a variety of investment preferences. Some are stringent financiers or easy capitalists entirely reliant on management to grow the company and generate returns.

Since the most effective gravitate toward the bigger offers, the middle market is a significantly underserved market. There are much more sellers than there are highly seasoned and well-positioned finance experts with substantial customer networks and sources to take care of a deal. The returns of private equity are commonly seen after a couple of years.

The Ultimate Guide To Custom Private Equity Asset Managers

Flying below the radar of large multinational corporations, much of these small companies frequently provide higher-quality customer support and/or particular niche services and products that are not being provided by the huge conglomerates (https://www.edocr.com/v/vld3w5ze/madgestiger79601/custom-private-equity-asset-managers). Such advantages bring in the rate of interest of personal equity firms, as they have the insights and savvy to manipulate such possibilities and take the business to the next degree

Many supervisors at portfolio firms are offered equity and bonus payment frameworks that reward them for striking their economic targets. Personal equity chances are typically out of reach for individuals who can not invest millions of bucks, however they shouldn't be.

There are laws, such as limits on the accumulation amount of cash and on the variety of non-accredited financiers. The private equity organization draws in a few of the most effective and brightest in company America, including leading performers from Ton of money 500 firms and elite monitoring consulting check that firms. Law practice can additionally be recruiting grounds for private equity employs, as audit and legal abilities are required to complete offers, and transactions are highly demanded. https://www.nairaland.com/6490712/signal-fastest-growing-app-world/58#127322862.

What Does Custom Private Equity Asset Managers Do?

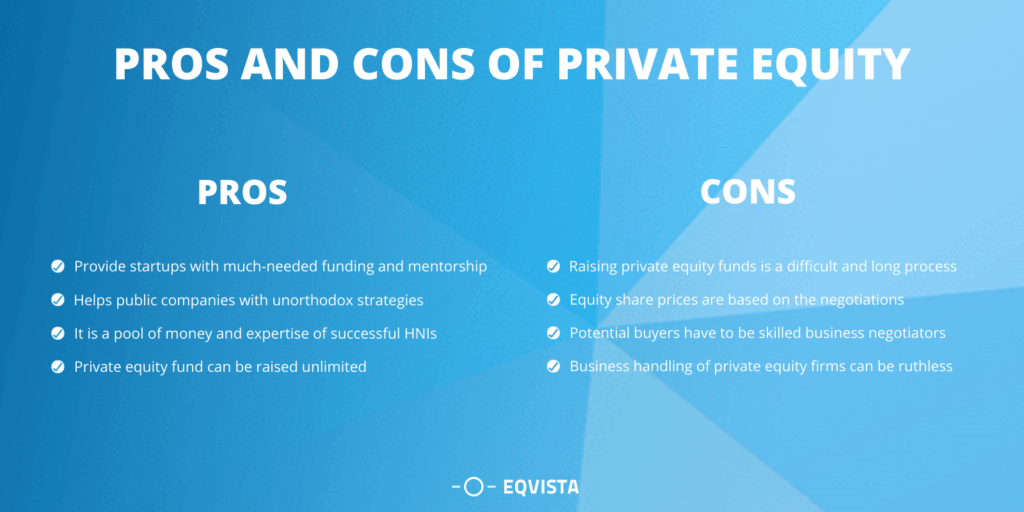

An additional disadvantage is the absence of liquidity; when in a personal equity purchase, it is hard to obtain out of or offer. There is a lack of adaptability. Exclusive equity likewise includes high costs. With funds under monitoring already in the trillions, private equity companies have ended up being attractive financial investment lorries for affluent individuals and institutions.

For decades, the qualities of personal equity have actually made the possession class an eye-catching recommendation for those that might get involved. Since accessibility to personal equity is opening approximately even more private financiers, the untapped capacity is coming true. The concern to take into consideration is: why should you invest? We'll begin with the main disagreements for buying personal equity: Just how and why private equity returns have historically been greater than various other properties on a number of degrees, Just how consisting of private equity in a profile influences the risk-return account, by aiding to diversify against market and cyclical danger, After that, we will certainly lay out some key factors to consider and dangers for private equity investors.

When it involves presenting a new possession into a profile, the a lot of fundamental factor to consider is the risk-return profile of that property. Historically, personal equity has exhibited returns similar to that of Emerging Market Equities and higher than all various other standard possession courses. Its reasonably low volatility combined with its high returns creates a compelling risk-return account.

Custom Private Equity Asset Managers Fundamentals Explained

Actually, personal equity fund quartiles have the largest series of returns across all different asset courses - as you can see listed below. Approach: Internal rate of return (IRR) spreads out determined for funds within classic years independently and after that balanced out. Typical IRR was computed bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund choice is critical. At Moonfare, we bring out a strict selection and due diligence process for all funds provided on the system. The result of including personal equity into a portfolio is - as always - depending on the profile itself. A Pantheon research from 2015 recommended that consisting of private equity in a portfolio of pure public equity can unlock 3.

On the other hand, the best private equity firms have accessibility to an also bigger swimming pool of unknown chances that do not encounter the exact same analysis, in addition to the sources to execute due persistance on them and identify which deserve purchasing (Private Equity Platform Investment). Spending at the very beginning indicates greater threat, yet for the companies that do be successful, the fund advantages from greater returns

Custom Private Equity Asset Managers Fundamentals Explained

Both public and exclusive equity fund managers commit to investing a portion of the fund yet there continues to be a well-trodden concern with straightening passions for public equity fund monitoring: the 'principal-agent trouble'. When a capitalist (the 'major') hires a public fund manager to take control of their resources (as an 'agent') they entrust control to the manager while keeping possession of the properties.

In the instance of exclusive equity, the General Partner doesn't simply make a monitoring cost. Private equity funds likewise alleviate one more kind of principal-agent trouble.

A public equity capitalist eventually wants one point - for the management to boost the supply price and/or pay dividends. The investor has little to no control over the choice. We revealed over the amount of private equity approaches - specifically bulk buyouts - take control of the operating of the business, guaranteeing that the long-term worth of the company comes initially, raising the return on financial investment over the life of the fund.

Report this wiki page